I Built Downcoding Defense Tools Nine Months Ago. This Week, NBC News Proved Why.

- revenuequestllc

- Oct 14, 2025

- 5 min read

Updated: Oct 31, 2025

Published: October 14, 2025

Last Updated: October 14, 2025

Author: Marketta Burrell, CRCP

Company: RevQuest LLC

Important Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, medical, or professional advice. Healthcare compliance requirements can vary by state, payer, and type of practice. Readers should consult with qualified healthcare attorneys, compliance professionals, and their professional advisors before implementing any compliance strategies discussed in this article. RevQuest LLC does not provide legal advice and recommends working with qualified legal counsel for specific compliance guidance.

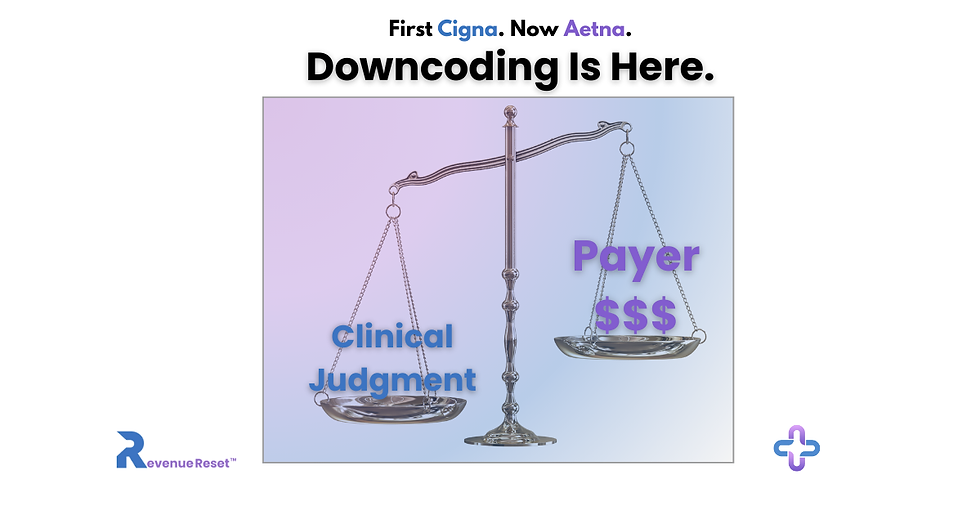

This article examines how Cigna Healthcare’s R49 policy and NBC News' recent investigation reveal a growing challenge for healthcare providers and how our Downcoding Defense Tools help practices stay compliant and protect their revenue.

When I launched Revenue Reset™ earlier this year, some wondered why I focused so heavily on payer downcoding. "Isn't that just part of billing?" they'd ask.

Revenue Reset™ is the educational and digital-product branch of RevQuest LLC, built to help healthcare providers, front office staff, and business office managers quickly fix revenue problems on their own.

It offers ready-to-use toolkits, templates, and guides that explain why insurance payments get reduced or denied and how to stop it from happening again. Think of it as a practical resource library that helps doctors, therapists, and clinic managers protect their income and stay compliant without needing to hire a full billing company.

On October 1, Cigna Healthcare rolled out its R49 Evaluation & Management (E/M) policy.

This week, NBC News gave me the answer: major insurers are automatically downcoding physicians nationwide, costing small practices thousands of dollars.

I started building solutions for this nine months ago because I saw what was coming and knew every practice needed to prepare."

Cigna Healthcare announced that its R49 Evaluation & Management (E/M) Coding Accuracy Policy would take effect on October 1, 2025. However, following pressure from the California Medical Association (CMA), Cigna Healthcare paused the rollout before it could fully launch. The damage to provider confidence, however, had already begun, and other insurers weren't waiting.

On October 9, 2025, NBC News published an investigation exposing what I’ve been watching unfold for months: major insurance companies are automatically reducing E/M codes and underpaying physicians nationwide, costing practices thousands of dollars.

Earlier this year, I began developing solutions for this because I anticipated what was ahead and understood that every practice needed to be ready. I recognized this as a way for many healthcare practices to address the appeals process and secure their billed payments.

Early Warning Signs of Insurance Downcoding

I noticed early warning signs when Cigna Healthcare announced its R49 Coding Accuracy Policy.

After 23 years in billing and revenue cycle management, I recognized the pattern immediately:

“Accuracy” initiatives that lead to sudden E/M downgrades.

Opaque explanations of benefits make audits harder.

Administrative burdens disguised as “quality assurance.”

I knew Cigna R49 wouldn’t stop with one payer.

Aetna’s Claim and Code Review Program (CCRP), UnitedHealthcare’s E/M edits, and some Blue Cross Blue Shield plans were already piloting similar measures.

That’s when I began building Downcoding Defense™ Tools, not from fear, but from pattern recognition and experience.

NBC News Confirms Widespread Downcoding Crisis

NBC News published an investigation exposing what I've been watching unfold for months...NBC News validated what RCM professionals have been warning for years: automation can’t replace clinical judgment.

Their investigation revealed that insurers, including Cigna Healthcare, Aetna, Anthem, and Humana, have relied on algorithm-driven systems that can automatically deny or downgrade medical claims without full human review.

Small and mid-size practices were hit hardest. As one provider told NBC, getting a denial overturned was “like breaking into Fort Knox.” Practices reported spending hours per week on appeals with no dedicated insurance representatives to call, just automated systems and delayed responses.

(🔗 Source: NBC News – “Cigna pauses use of algorithm that denied medical claims automatically,” October 9, 2025)

Why Self-Service Solutions Matter

Most consultants charge $200 or more per hour, and practices rarely have the time or budget to wait weeks for answers.

That's why I created the Universal Downcoding Defense Kit, a complete, step-by-step system covering Aetna, Anthem, Cigna, Humana, and all major payers. Think of it as the TurboTax of medical billing compliance: professional-grade tools you can use immediately, without consultant fees.

If you’re just getting started, the Quick Start Checklist helps you document correctly from day one and avoid common pitfalls.👉 Get the Quick Start Checklist

Already being downcoded? The Appeals Letter Kit gives you seven ready-to-use templates that let you respond immediately and effectively.👉 View the Appeals Letter Kit

No waiting. No guesswork. Just action.

Real Results: A Case Study

At RevQuest LLC™, we've seen what proactive systems can do. Using our R.O.O.T. Method™, we helped one practice uncover $25,000 in lost revenue within 45 days, all by addressing overlooked claim patterns and weak follow-up protocols. That same root-cause mindset drives every Revenue Reset™ product today.

The Bigger Picture

This is not about panic; it is about preparation. Downcoding is evolving, not going away. With the right tools and documentation practices, providers can maintain compliance and safeguard their revenue.

If NBC's investigation was your wake-up call, this is your action plan. Don't wait for your first downcode to scramble for solutions. Explore the tools built to defend your work before the next headline proves why you needed them.

Cigna Healthcare is a registered trademark of Cigna Intellectual Property, Inc. References to Cigna Healthcare’s R49 policy are for informational and educational purposes only. Revenue Reset™ and RevQuest LLC™ are independent entities and are not affiliated with or endorsed by Cigna Healthcare.

Marketta Burrell, CRCP, is the founder and CEO of RevQuest LLC™ and Revenue Reset™, bringing over 23 years of healthcare revenue cycle management expertise to compliance consulting. As a Certified Revenue Cycle Professional (CRCP) through AAHAM, Marketta has specialized in denial management, revenue cycle management, A/R recovery, and regulatory compliance across multiple healthcare settings, including physical therapy, hospitals, skilled nursing facilities, and specialty practices.

Her hands-on experience as Business Office Manager includes managing compliance requirements at Bluegrass Physical Therapy for six years, reducing aged A/R by 60% at specialty practices, and recovering over $55K in complex claims before timely filing deadlines. Marketta's Revenue Reset™ methodology has helped healthcare practices navigate regulatory changes while maintaining operational efficiency and financial stability.

Sources & Further Reading

NBC News (2025). Cigna pauses use of an algorithm that denied medical claims automatically.

Burrell, M. (2025). The Hidden Strategy Behind Cigna’s R49 Downcoding Policy. RevQuest LLC.

Burrell, M. (2025). When R49 Claims Get Denied — Your Appeals Options. RevQuest LLC.

Burrell, M. (2025). The First Week of Cigna R49. RevQuest LLC.

RevQuest LLC (2025). A/R Recovery That Saved a PT Clinic from $25K in Lost Revenue.

RevQuest LLC (2025). The 8-Minute Rule Explained: How a Single Mistake Can Cost PT Clinics Over $10K Monthly.

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

This makes a strong case for why downcoding defense can’t be reactive anymore.

Are the tools mentioned in the article available somewhere for practices to review or implement? I really would like to try to see if this will work for my practice.

This really puts into context why proactive downcoding defense matters. It’s one thing to talk about patterns and risk, and another to see major media highlight the same issue practices face every day. Tools and frameworks that help teams spot and address downcoding early aren’t just nice to have they protect revenue that silently erodes when reductions are normalized.

Curious how others are adapting their review workflows in response.

This really put language to what a lot of us have been seeing but couldn’t quite pin down. The issue isn’t documentation in isolation — it’s how E/M is being re-evaluated after the fact using criteria that don’t feel aligned with CPT intent.

What stood out to me is the pattern you describe. These aren’t random downgrades. They follow the same logic across payers, which makes it much harder to dismiss as provider error. If you’re responsible for A/R or denials, this explains why appeals feel like you’re arguing against a moving target.

This was a helpful read, especially for anyone trying to understand why compliant claims are still getting reduced.