Understanding Cigna's R49 Policy: A Critical Update for Providers

- revenuequestllc

- Sep 24, 2025

- 4 min read

Updated: Oct 31, 2025

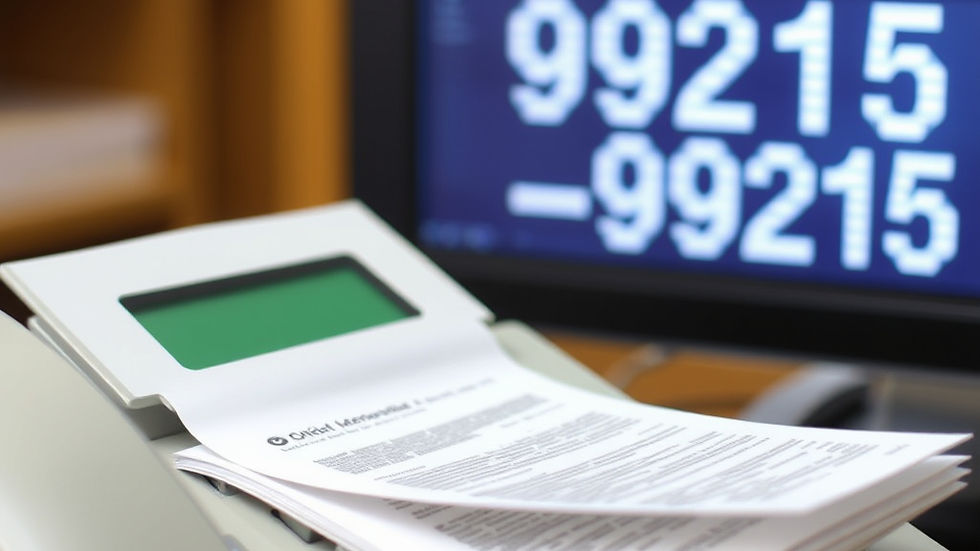

As the healthcare industry braces for the implementation of Cigna's new Evaluation & Management (E/M) Coding Accuracy Policy (R49), providers are scrambling to understand its implications. This policy goes into effect on October 1, 2025, which is less than one week away.

The Implications of Cigna's R49 Policy

This policy is more than just a quality-control measure; it's a strategic move that could significantly impact your practice's revenue. Opponents argue that Cigna's R49 policy is also a cost-saving strategy that shifts risk and administrative burden directly onto providers.

Key Concerns

Here’s the key concern:

"Opponents of the strategy say Cigna may be expecting that busy practices will not have the time or resources to appeal every improperly downcoded claim, resulting in a net savings for Cigna. This approach, they say, undermines the clinical judgment of physicians and places yet another administrative obstacle in the path of provider financial stability," according to HealthLeaders Media.

Why This Matters

Automatic downcoding = automatic savings for the payer. If only a fraction of providers fight back through appeals, the rest of the revenue slips away quietly.

Fax-only appeals add friction. There is no electronic reconsideration pathway. This is intentional administrative drag.

Physician judgment is at stake. The policy implies that documentation templates outweigh clinical decision-making.

The Real Risk for Providers

It's not just about the percentage of claims that get adjusted. It's about the behavioral effect:

Busy practices may undercode to avoid the hassle.

Overloaded staff may skip appeals.

Revenue leaders may not realize the cumulative effect until it's too late.

In both cases, the payer wins, and providers absorb the loss. For a mid-sized practice billing 500 E/M codes monthly, even a 15% downcode rate on higher-level visits could result in $50,000+ annual revenue loss.

Critical Last-Week Action Plan

With R49 launching in days, here's your emergency timeline:

TODAY (September 24-25)

Immediate Baseline Assessment: Pull your last 90 days of Cigna E/M claims data.

Risk Quantification: Calculate potential revenue exposure by service level.

Staff Alert: Brief your billing team on the policy change.

How Revenue Reset Tools Help: Use our Rapid Revenue Assessment to instantly identify your highest-risk claim categories and quantify potential losses within 24 hours.

SEPTEMBER 26-27 (THIS WEEKEND)

Documentation Audit: Review templates for 99213-99215 visits.

Appeal Workflow Setup: Designate staff for fax-based reconsiderations.

Provider Communication: Send an urgent memo to all clinicians.

How Revenue Reset Tools Help: Our Revenue Reset™ Cigna R49 Appeals Letter Kit (Core) provides ready-to-use appeal processes and staff assignment matrices that can be implemented immediately.

SEPTEMBER 28-30 (FINAL BUSINESS DAYS)

EHR Template Optimization: Strengthen documentation for complex visits.

Financial Tracking Setup: Create KPIs to monitor downcode impact.

Board/Leadership Brief: Present exposure analysis and mitigation plan.

How Revenue Reset Tools Help: The Revenue Reset™ Cigna R49 October 1st Prep Checklist (Extended Edition) includes tools to track downcoding patterns, monitor appeal success rates, and generate board-ready financial impact reports.

OCTOBER 1+ (ONGOING DEFENSE)

Daily Monitoring: Track downcode rates and patterns.

Systematic Appeals: Fight every inappropriate adjustment.

Performance Review: Weekly assessment of financial impact.

How Revenue Reset Tools Help: Our Appeals Capacity Framework shows you how to centralize submissions, track outcomes, and build an evidence library that strengthens every reconsideration.

What Leaders Must Do Today About Cigna R49

Acknowledge the strategy. Don’t dismiss this as a routine audit.

Quantify exposure. Run your E/M distribution reports now.

Prepare appeals capacity. Who will handle the fax-based reconsiderations?

Educate clinicians. Stress clarity in documentation without adding burnout.

Bottom Line

Cigna's R49 policy isn't just about documentation accuracy; it's a strategic move for leverage. The payer knows that many providers won't fight every adjustment. With less than a week to prepare, every small adjustment will compound into thousands deducted from your budget over the coming months.

The time for preparation has passed. Now it's about rapid response and damage control. Each minor modification will result in a reduction of thousands from your budget.

📥 I’m finalizing the Revenue Reset™ Cigna R49 October 1st Prep Checklist (Extended Edition) — a practical playbook built for CEOs, CFOs, and compliance leaders. It breaks down the last week's action steps, monitoring tools, and board-ready reporting you’ll need once R49 goes live.

Learn more at revquestrcm.com/revenue-reset, your hub for R49 executive tools, including the Appeals Letter Kit and Revenue Reset™ Cigna R49 October 1st Prep Checklist (Extended Edition).

Marketta Burrell, CRCP, is the founder and CEO of RevQuest LLC™ and Revenue Reset™, bringing over 23 years of healthcare revenue cycle management expertise to compliance consulting. As a Certified Revenue Cycle Professional (CRCP) through AAHAM, Marketta has specialized in denial management, A/R recovery, and regulatory compliance across multiple healthcare settings, including physical therapy, hospitals, skilled nursing facilities, and specialty practices.

Her hands-on experience as Business Office Manager includes managing compliance requirements at Bluegrass Physical Therapy for six years, reducing aged A/R by 60% at specialty practices, and recovering over $55K in complex claims before timely filing deadlines. Marketta's Revenue Reset™ methodology has helped healthcare practices navigate regulatory changes while maintaining operational efficiency and financial stability.

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

Comments