5 RCM Challenges Unique to Minority-Owned Healthcare Practices

- revenuequestllc

- Nov 7, 2025

- 13 min read

Published: November 7, 2025

Last Updated: November 7, 2025

Author: Marketta Burrell, CRCP

Company: RevQuest LLC

Important Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, medical, or professional advice. Healthcare compliance requirements can vary by state, payer, and type of practice. Readers should consult with qualified healthcare attorneys, compliance professionals, and their professional advisors before implementing any compliance strategies discussed in this article. RevQuest LLC does not provide legal advice and recommends working with qualified legal counsel for specific compliance guidance.

Minority-owned healthcare practices are often the backbone of underserved communities, delivering culturally competent care in areas where larger health systems may have little reach.

Yet these practices—whether Black-, Hispanic-, AAPI-, or Native American-owned—face disproportionate challenges in keeping their revenue cycles healthy and their doors open.

In our June 2025 blog, Stop Losing Revenue: Why A/R Recovery Audits Matter for Healthcare Practices, we explored how identifying where revenue is silently leaking can lead to thousands in recoverable income.

Today, we delve deeper into how systemic challenges uniquely impact minority-owned providers and explore potential solutions.

After 23 years in revenue cycle management (RCM), I've identified five distinct barriers that disproportionately affect minority-owned practices. These aren't about clinical skills or work ethics. They're about systemic disadvantages that make getting paid harder.

1. Limited Access to Billing Infrastructure and Technology

The technology gap between large health systems and small minority-owned practices is not just about convenience; it's about revenue survival.

The Reality:

Many minority-owned clinics operate with outdated practice management systems, limited EHR functionality, or even rely on paper-based processes.

Amid the COVID-19 pandemic, 90% of members of the New Jersey Black Medical Association reported that inadequate technological support hindered their shift to telehealth, resulting in lost revenue as in-person appointments declined.

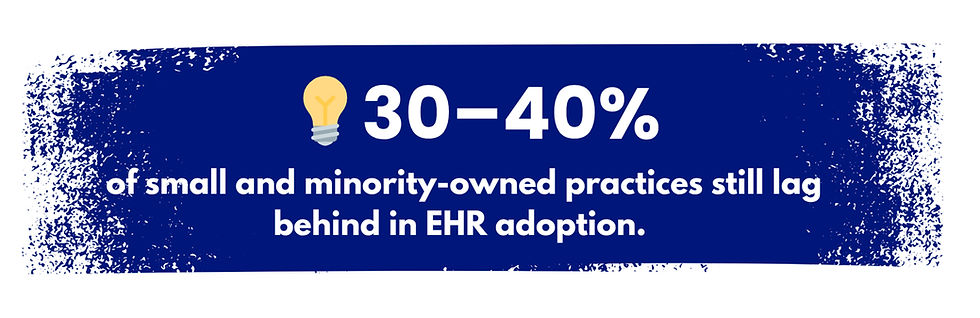

Small practices have 30-40% lower advanced EHR adoption rates compared to those of hospital-based providers.

Without modern billing technology, these practices miss out on several critical capabilities:

Automated claim scrubbing (errors go undetected until denial)

Real-time eligibility verification (claims submitted to the wrong payers)

Integrated denial tracking (patterns go unnoticed)

Analytics dashboards (can't identify where money is leaking)

Why It's Worse for Minority Practices:

Access to capital for technology upgrades is limited. Black-owned businesses are rejected for loans at 3x the rate of white-owned businesses, even with comparable credit profiles. When you can't afford a $10,000-$30,000 RCM system upgrade, you're competing with one hand tied behind your back.

What Helps:

Cloud-based RCM platforms with affordable monthly pricing (no large upfront investment).

Outsourced billing services that provide technology infrastructure as part of the service

Partnerships with vendors offering scaled solutions for small practices.

Grants and loan programs specifically for healthcare IT (HRSA, state programs).

Payer Disparities and Implicit Bias

This is the challenge nobody wants to talk about openly, but the data is undeniable.

The Reality:

Minority-owned practices often experience:

Higher denial rates - Even with accurate coding, claims get denied more frequently.

Longer payment delays - Reimbursements that should take 30 days can now take 60-90 days.

More "routine" audits - Disproportionate scrutiny compared to similar practices.

Systematic underpayment - Medicaid reimburses only 88 cents per dollar spent on care.

The disparity manifests differently across communities:

Black-Owned Practices: An African American-owned pain clinic in Maryland alleges that Optum systematically denied over $1 million in valid claims while approving identical claims from non-minority practices. The lawsuit describes Optum rejecting submissions without justification beginning in 2022, forcing layoffs and emergency loans.

Black physicians are more likely to serve in medically underserved areas and treat a higher proportion of Black patients, who are often on Medicaid.

Practices serving predominantly Black patients spend 30% less time per patient due to lower reimbursement rates and higher volume demands. During COVID-19, 41% of Black-owned businesses were at risk of not surviving, compared to 17% of white-owned businesses.

Black-owned businesses are rejected for loans at three times the rate of white-owned businesses, even with comparable credit profiles.

Hispanic-Owned Practices: Hispanic physicians comprise only 5-6% of doctors despite being 19% of the U.S. population, yet they disproportionately serve Hispanic communities.

These practices often treat patients with limited English proficiency or recent immigrants with no insurance, adding complexity to billing. Language barriers make obtaining accurate patient information and communicating coverage requirements more difficult.

Hispanic-owned clinics frequently see higher uninsured rates, creating greater volumes of self-pay accounts and increased A/R burden.

Cultural expectations can also affect collections—some Latino patients may avoid collection calls due to distrust or misunderstanding, leaving practices with mounting receivables.

AAPI (Asian American/Pacific Islander) Practices: Many AAPI providers serve immigrant communities with language barriers, requiring bilingual staff and extra documentation translation costs that aren't reimbursed.

Some AAPI physicians report experiencing patient discrimination that affects billing compliance (patients refusing to return for follow-up or pay bills).

Additionally, AAPI-owned practices in ethnic enclaves may serve largely cash-pay populations, making insurance navigation more complex when patients do have coverage.

Native American Practices: Native-owned or tribal clinics face perhaps the most severe payment challenges.

The Indian Health Service (IHS), which covers many Native patients, is chronically underfunded and slow to pay outside providers.

A 2024 federal report found IHS was often late paying bills, leading to patients and providers being sent to collections for charges the government should have covered.

This contributed to Native-majority communities having nearly twice the rate of medical debt in collections as the U.S. average. Even when claims are valid, reimbursement delays of 6-12 months are common, devastating cash flow.

The Data:

Healthcare claim denials rose to 11% in 2022, up from 8% in 2021.

Native American communities face medical debt collection rates nearly 2x the national average.

Only 5-6% of U.S. physicians are Hispanic (despite 19% of the population being Hispanic)

AAPI providers often lack mentorship in U.S. billing systems if they were trained abroad.

That's not billing errors. That's systematic disparity.

What Helps:

Payer-specific denial tracking (document patterns of bias across all payers, including IHS).

Systematic appeals process (don't accept denials without a fight).

Revenue cycle analytics to flag outlier denial rates by payer and patient population.

Legal advocacy when patterns suggest discrimination.

Partnering with RCM specialists who understand community-specific challenges.

For IHS billing: Advocacy for policy changes and working with tribal health administrators.

For AAPI practices: Cultural competency in billing for diverse immigrant populations.

Translation services and documentation support for limited English proficiency patients.

Compliance Landmines and Downcoding Threats

Keeping up with constantly changing billing rules is hard for any practice. For small minority-owned clinics with limited staff and no dedicated compliance officer, it's nearly impossible.

The Compliance Burden:

Without specialized knowledge, minority practice staff may not understand:

8-Minute Rule for Therapy - Physical therapy and time-based services require meticulous tracking. Bill incorrectly, and you're either leaving money on the table or risking audit penalties.

Cigna R49 Policy - Cigna's nationwide policy now downcodes evaluation and management (E/M) visits based on its own internal criteria, often reducing Level 4 visits to Level 3. This can cost practices thousands monthly if not properly documented and appealed.

Aetna CCRP (Clinical Care Review Program) - Aetna's systematic review of E/M coding results in one-level downcodes even when documentation supports the billed level. Many practices don't realize this is happening until they review EOBs closely.

Modifier Requirements - Incorrect use of modifiers or omitting them results in immediate denials. Examples include: -25 for separate E/M services, -59 for distinct procedures, and KX for therapy surpassing thresholds.

Documentation Standards - CMS's evolving E/M documentation rules, medical necessity requirements, and time-based vs. complexity-based coding continue to shift. Without ongoing training, staff fall behind.

The Staff Knowledge Gap:

Many minority-owned practices have front desk staff handling billing, or physicians coding their own encounters after hours. These team members may not have:

Formal coding certification (CPC, CCS).

Regular continuing education on rule changes.

Experience with complex payer-specific policies.

Time to research denial reasons and appeal properly.

A 2022 survey found 64% of healthcare finance leaders ranked coding errors and denials management as their top RCM challenges. For small practices without dedicated billing expertise, this challenge is magnified.

What Helps:

Quarterly coding audits to catch errors before payers do.

Staff training on current billing rules and payer policies.

Templates for common encounter types (reduces documentation errors).

Outsourced coding review for complex cases.

Denial management specialists who understand Cigna R49, Aetna CCRP, and other downcoding plans.

Real-time claim scrubbing before submission.

Bottom line: You can't comply with rules you don't know exist. And you can't fight downcoding if you don't recognize it's happening.

Inconsistent Cash Flow and Late Claim Submissions

Cash flow instability is the silent killer of minority-owned practices.

The Reality:

Independent practices serving underserved populations face:

30%+ monthly revenue fluctuations - One slow week can mean payroll challenges.

No financial cushion - Less than 25% have 3 months of operating expenses in reserves.

20%+ of A/R aging past 90 days - Old claims become uncollectable, yet staff have no time to work them.

Delayed claim submissions - When staff are overwhelmed, claims sit for 5-10 days after service (increasing denial risk).

During COVID-19, 41% of Black-owned businesses and 32% of Latino-owned businesses closed in the early months, compared to 17% of white-owned businesses. The difference? Thinner cash reserves and weaker access to emergency funding.

The Vicious Cycle:

Thin margins mean no buffer for slow-pay months.

Can't afford a dedicated billing staff to chase old claims.

A/R ages out; revenue is permanently lost.

Even thinner margins, more financial stress.

Repeat.

What Helps:

Systematic A/R management (weekly review of aging reports).

Outsourced A/R follow-up for claims over 60 days.

Front-end revenue optimization (eligibility verification, upfront collections).

Contingency-based recovery services (you only pay when money is collected).

Cash flow forecasting and reserve building strategies.

Same-day or next-day claim submission processes.

The opportunity: Most practices have $15,000-$50,000 sitting in aged A/R that's recoverable with proper follow-up. That's your cash flow cushion waiting to be claimed.

5. Lack of Mentorship and Networking in RCM Strategy

You didn't go to medical school to become a billing expert. Yet as a minority practice owner, you're often figuring out RCM through expensive trial and error.

The Isolation:

No RCM advisor or consultant you can call for guidance.

Not connected to other minority practice owners sharing best practices

Learned billing processes through mistakes, not formal training.

Don't know industry benchmarks (Is your 8% denial rate normal or terrible?)

Feel alone when facing complex payer disputes.

Only 5-6% of U.S. physicians are Hispanic, despite 19% of the population being Hispanic. Black physicians are even more rare. This underrepresentation means fewer mentors who understand both the clinical and business challenges of running a minority-owned practice in an underserved community.

Why Mentorship Matters in RCM:

As I wrote in my article Mentorship and Collaboration: Foundations of Effective Leadership in Revenue Cycle Management, mentorship isn't just about career development; it directly impacts your practice's financial performance.

At the beginning of my career as a Business Office Manager in a physical therapy clinic, I was mentored by an experienced physical therapist for six years. This mentorship significantly changed my perspective on RCM.

Previously, my knowledge was limited to basic billing concepts. With my mentor's guidance, I explored the complexities of:

Insurance reimbursement strategies.

Coding for therapeutic procedures.

The critical importance of accurate documentation.

How billing decisions impact both patient care and financial viability.

This mentorship didn't just advance my career; it made me a more effective revenue cycle professional.

The same principle applies to practice owners: Having an experienced RCM advisor can prevent costly mistakes and accelerate your financial success.

The Cost of Learning Alone:

Submitting to the wrong payer (wasted time, delayed payment).

Not appealing a denial because you didn't know it was appealable.

Missing contract negotiation opportunities with payers.

Accepting lower reimbursement rates because you didn't know how to negotiate.

Hiring the wrong billing company because you had no one to ask for recommendations.

Failing to recognize downcoding patterns (Cigna R49, Aetna CCRP) until thousands are lost.

Without mentorship, you're reinventing the wheel and paying tuition in lost revenue.

Professional Networks:

National Medical Association (NMA)

National Hispanic Medical Association (NHMA)

Association of American Indian Physicians (AAIP)

Association of Asian Pacific Community Health Organizations (AAPCHO)

National Association of Health Services Executives (NAHSE)

Medical Group Management Association (MGMA)

RCM-Specific Resources:

RCM consultants who specialize in small and minority-owned practices.

Peer networking groups (local medical societies, minority business chambers).

Formal practice management education (MGMA, AAPC courses).

Having an experienced RCM advisor on retainer.

Building Collaborative Relationships:

As I discussed in my mentorship article, healthcare requires collaboration across disciplines. Effective RCM relies on cooperation between finance, IT, clinical departments, and administrative staff. Minority practice owners often lack access to these collaborative networks that larger systems take for granted.

Creating your own advisory circle, whether through professional associations, peer groups, or consulting relationships, can bridge this gap.

The mindset shift: Asking for help isn't a weakness, it's a strategy. Every successful practice owner has a network of trusted advisors. You need yours.

📋 How Many of These Challenges Is Your Practice Facing Today?

Before you close this article, take 5 minutes to assess your own practice.

I've created an interactive RCM self-assessment designed for minority-owned and independent healthcare practices.

It helps you:

Identify which of these 5 revenue challenges is affecting your bottom line.

Calculate your current revenue risk score (0-25 points).

Get tailored recommendations based on your responses.

Determine whether you’d benefit from a Revenue Readiness Review.

✅ Takes 5 minutes

✅ Instant summary

✅ Personalized recommendations

✅ No obligation

After you complete it, come back and continue reading below.

How These 5 RCM Challenges Affect Different Communities

While the five core challenges affect all minority-owned practices, each community faces unique nuances:

Black-Owned Practices:

Disproportionately serve in medically underserved areas with higher Medicaid populations

Face documented bias in claim approvals (Maryland Optum case).

Higher risk of loan denial for technology upgrades (3x rejection rate).

Experienced severe financial strain during COVID (41% at risk of closure).

Often lack generational wealth to weather cash flow gaps.

Hispanic-Owned Practices:

Serve communities with high uninsured rates and language barriers.

Need bilingual staff (added expenses not reimbursed by payers)

Navigate complex eligibility for immigrant patients.

Underrepresented in the physician workforce (5-6% of doctors vs. 19% of the population).

May lack formal RCM training due to being first-generation practice owners.

AAPI-Owned Practices:

Serve diverse ethnic enclaves with varying insurance coverage patterns.

May face patient discrimination affecting collections and compliance.

Often trained abroad, requiring navigation of U.S. coding systems without mentorship.

Balance cultural expectations with Western billing norms.

May handle cash-pay populations requiring different revenue strategies.

Native American-Owned Practices:

Serve communities with the highest uninsured/underinsured rates.

Deal with IHS payment delays of 6-12 months (devastating for cash flow).

Operate in rural areas with limited technology infrastructure.

Face medical debt collection rates 2x the national average in tribal communities.

Provide culturally necessary services that aren't billable to insurance.

Navigate federal, state, and tribal bureaucracies for reimbursement.

The common thread: All face systemic barriers that make revenue cycle management harder than it should be.

The Bottom Line: These Challenges Are Fixable

Minority-owned healthcare providers face an uphill battle—not because of inferior care or lack of effort, but because of systemic and operational disadvantages that make getting paid harder.

But here's the truth: Every single one of these challenges is solvable.

Technology gaps? Cloud-based solutions and outsourced services can close them.

Payer bias? Documentation, tracking, and aggressive appeals can fight it.

Compliance confusion? Training and expert review can prevent costly errors.

Cash flow crises? A/R recovery can inject $20K-$50K back into your practice in 60-90 days.

Lack of mentorship? Professional networks and RCM advisors can guide you.

The question isn't whether these problems exist.

The real question is: What are you going to do about them?

Take Action: Protect Your Practice's Revenue

Step 1: Complete the Minority Practice RCM Self-Assessment

Find out which of these 5 challenges may be costing your practice thousands each month.

You'll receive:

Your personalized revenue-risk overview.

Key areas affecting your billing and collections.

Estimated recoverable revenue potential.

Recommended next steps for stability and growth.

Step 2: Schedule Your Revenue Readiness Review

I’m offering priority A/R reviews for minority-owned healthcare practices that want to understand what’s really happening inside their revenue cycle this month.

On our call, I'll:

✅ Review which of these 5 challenges is affecting you most.

✅ Identify potential recoverable revenue in your aged A/R.

✅ Recommend prioritized action steps.

✅ Explain next-step options to stabilize cash flow

Each review is tailored to your practice, no generic advice, no templates.

Just 23 years of RCM expertise focused on your operations and payer mix.

📧 Email: contact@revquestrcm.com

Step 3: Share This Resource

If you know another minority-owned practice facing billing, denial, or cash flow challenges, share this checklist or article with them.

Together, we can build stronger, financially sustainable practices and protect your community’s access to care.

Defending provider judgment. Preserving practice stability.

Revenue Cycle Management & A/R Recovery

Serving Minority-Owned Healthcare Practices Nationwide

© 2025 RevQuest LLC. All rights reserved.

Cigna Healthcare is a registered trademark of Cigna Intellectual Property, Inc. References to Cigna Healthcare’s R49 policy are for informational and educational purposes only. Revenue Reset™ and RevQuest LLC™ are independent entities and are not affiliated with or endorsed by Cigna Healthcare or any other payer referenced.

About the Author - Marketta Burrell, CRCP

With 23 years of revenue cycle management experience and CRCP certification, I've seen firsthand how systemic barriers disproportionately impact minority-owned healthcare practices.

I started RevQuest LLC with a mission: to help healthcare providers overcome these challenges and build financially sustainable practices that can serve their communities for generations.

My approach is different:

Contingency-based A/R recovery (you only pay when I collect money)

No long-term contracts (flexibility for small practices)

Specialized expertise in payer disputes (Cigna R49, Aetna CCRP, downcoding appeals)

Cultural competency (I understand the unique challenges you face)

Certifications: CRCP (Certified Revenue Cycle Professional)

Experience: 23+ Years in Medical Billing & RCM

Ready to Stop Losing Revenue?

📚Sources & Further Reading

Burrell, Marketta. Stop Losing Revenue: Why A/R Recovery Audits Matter for Healthcare Practices. RevQuest LLC. June 12, 2025.

Burrell, Marketta. Mentorship and Collaboration: Foundations of Effective Leadership in Revenue Cycle Management. RevQuest LLC.

American Medical Association (AMA). Physician Burnout and Administrative Burdens in Independent Practices. 2023.

Centers for Medicare & Medicaid Services (CMS). Medicare 8-Minute Rule Billing Guidelines. 2025 Update.

Commonwealth Fund. Medicaid Reimbursement Rates Are a Racial Justice Issue. June 2022.

Federal Reserve Bank. Small Business Credit Survey: Minority-Owned Firms. 2022.

KFF Health News. Medical Debt Crisis in Native American Communities. April 2024.

McKinsey & Company. The Economic Opportunity of Closing the Revenue Gap for Minority-Owned Businesses. 2021.

Medical Group Management Association (MGMA). Benchmarking Report on Staffing and Revenue Cycle Priorities. 2023.

National Hispanic Medical Association (NHMA). Provider Access and Equity in Latino Communities. 2024.

RevQuest LLC. Case Study: $25,000 Recovered in 45 Days. 2025.

Rutgers Today. COVID-19’s Impact on Black-Owned Healthcare Practices. December 2020.

WebPT. State of Rehab Therapy Report – Claim Denials & Billing Trends. 2024.

Justly Prudent Legal Review. Choice Pain & Rehab Center v. Optum. 2024.

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

Comments