The First Week of Cigna R49: What Practices Haven't Felt Yet

- revenuequestllc

- Oct 3, 2025

- 5 min read

Updated: Oct 31, 2025

Published: October 3, 2025

Last Updated: October 3, 2025

Author: Marketta Burrell, CRCP

Company: RevQuest LLC

Important Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, medical, or professional advice. Healthcare compliance requirements can vary by state, payer, and type of practice. Readers should consult with qualified healthcare attorneys, compliance professionals, and their professional advisors before implementing any compliance strategies discussed in this article. RevQuest LLC does not provide legal advice and recommends working with qualified legal counsel for specific compliance guidance.

On October 1, Cigna Healthcare implemented its new R49 policy, introducing more stringent medical complexity criteria for Evaluation and Management (E/M) code reimbursement. For most practices, it may seem like business as usual.

Claims are still going out the door. Documentation is still being entered, and nothing unusual has appeared on your remittance reports.

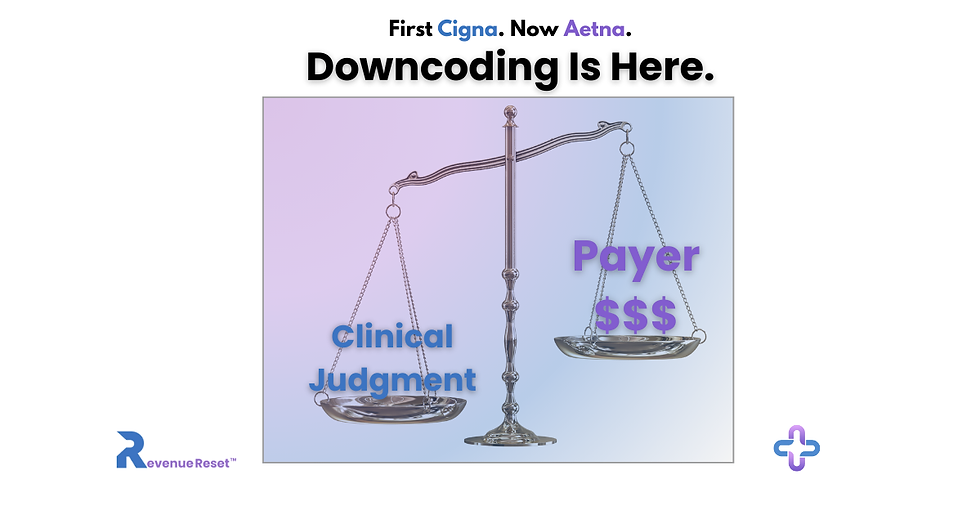

But here's the catch: downcoding has already started.

Why You Won't See It Right Away

Cigna Healthcare is now automatically reducing many higher-level E/M codes (99204–99205, 99214–99215, 99244–99245) unless documentation meets its new criteria for medical complexity. Instead of being paid for the level of service you billed, your claim is dropped to a lower code.

The problem is timing. Claims filed this week won't reconcile until your October payments post, most likely in November. That means October's revenue reductions are invisible right now. You won't feel the cut until weeks from now, when an Explanation of Benefits (EOBs) lands and you're left reconciling the difference.

It's a lag that makes this policy especially dangerous. By the time you see the shortfall, it's already too late to prevent it.

What This Looks Like in Real Numbers

Consider a Level 5 established patient visit billed at $250. Under Cigna R49, that claim may be downcoded to a Level 3 reimbursed at roughly $125. One patient visit, one silent reduction.

Now multiply that across a day's worth of visits, then a month's worth of claims, and the losses add up fast. Practices may not notice until revenue drops by tens of thousands of dollars, all without a single denial notice.

Why Waiting for a Reversal Isn't a Plan

Groups such as the American Medical Association (AMA), California Medical Association (CMA), and Texas Medical Association (TMA) have labeled Cigna Healthcare's method as illegal and onerous, and they are correct.

Despite ongoing legal disputes, Cigna Healthcare continues with implementation without hesitation. Claims for October are currently being modified, regardless of whether you've observed it.

Counting on an exemption won't safeguard this month's or November's income; you must have a defense plan in place today.

Prevention vs. Reaction: A Different Approach

Healthcare providers educate patients on preventive measures to avoid ailments and maintain their health. Similarly, this concept applies to your revenue health. This concept applies to your revenue health as well. Waiting to react to downcoded EOBs is akin to treating a condition after it has progressed.

The proactive approach involves taking preventive steps now, such as obtaining one of the Revenue Reset™ solutions, to prevent automatic downcoding before it impacts your bottom line.

Consider it like this: you wouldn't wait for a patient's blood pressure to become critical before taking action. You monitor, make adjustments, and prevent escalation. Your practice's revenue functions in a similar manner. Preventing downcoding now is much easier than attempting to recover lost income weeks later.

Where to Start

The practices that will protect their revenue are doing three things right now:

1. Reviewing documentation against the new requirements before claims go out. The Revenue Reset™ R49 Quick Start Checklist walks you through what changed on October 1 and where to adjust immediately so you can stop the bleeding before more claims get flagged.

2. Tightening clinical documentation to meet Cigna Healthcare's medical complexity thresholds. The Revenue Reset™: Document It or Lose It – R49 Documentation Checklist gives you practical, visit-by-visit criteria to ensure your documentation supports the level you're billing.

3. Preparing an appeals workflow before downcoded EOBs arrive. When the first reductions hit, the Revenue Reset™ Cigna R49 Appeals Letter Kit (Core) helps you respond immediately with ready-to-use templates, a fax cover sheet, and a step-by-step workflow, so you're not scrambling to build a process from scratch.

The Bottom Line on Cigna R49

October claims are being cut right now. The only question is whether you'll notice in November or prepare today.

Don’t wait until the EOBs arrive. Start with the Revenue Reset™ R49 Quick Start + Revenue Reset™: Document It or Lose It – R49 Documentation Checklist and protect this month’s revenue:

Cigna Healthcare is a registered trademark of Cigna Intellectual Property, Inc. References to Cigna Healthcare’s R49 policy are for informational and educational purposes only. Revenue Reset™ and RevQuest LLC™ are independent entities and are not affiliated with or endorsed by Cigna Healthcare.

Marketta Burrell, CRCP, is the founder and CEO of RevQuest LLC™ and Revenue Reset™, bringing over 23 years of healthcare revenue cycle management expertise to compliance consulting. As a Certified Revenue Cycle Professional (CRCP) through AAHAM, Marketta has specialized in denial management, revenue cycle management, A/R recovery, and regulatory compliance across multiple healthcare settings, including physical therapy, hospitals, skilled nursing facilities, and specialty practices.

Her hands-on experience as Business Office Manager includes managing compliance requirements at Bluegrass Physical Therapy for six years, reducing aged A/R by 60% at specialty practices, and recovering over $55K in complex claims before timely filing deadlines. Marketta's Revenue Reset™ methodology has helped healthcare practices navigate regulatory changes while maintaining operational efficiency and financial stability.

Sources

Cigna Healthcare. New Reimbursement Policy for Professional Evaluation and Management (E/M) Claims – Policy R49. Effective October 1, 2025.

California Medical Association (CMA). Statement on Cigna’s Downcoding Policy R49. October 2025.

Texas Medical Association (TMA). TMA Joins Opposition to Cigna’s New R49 Downcoding Rule. October 2025.

American Medical Association (AMA). Cigna Policy Change Threatens Provider Judgment and Patient Care. October 2025.

American Academy of Sleep Medicine (AASM). Cigna and Aetna Downcoding Policies Undermine Complex Care Reimbursement. October 2025.

Aetna. Clinical Claim Review Program (CCRP) – Provider Impact Update. March 2025.

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

Comments