What the UNC Health–Cigna Contract Dispute and Termination Means for Providers, Patients, and Revenue in 2025-2026

- revenuequestllc

- Nov 30, 2025

- 8 min read

Updated: Dec 2, 2025

Published: November 30, 2025

Last Updated: December 2, 2025

Author: Marketta Burrell, CRCP

Company: RevQuest LLC

Important Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, medical, or professional advice. Healthcare compliance requirements can vary by state, payer, and type of practice. Readers should consult with qualified healthcare attorneys, compliance professionals, and their professional advisors before implementing any compliance strategies discussed in this article. RevQuest LLC does not provide legal advice and recommends working with qualified legal counsel for specific compliance guidance.

🚨 BREAKING UPDATE (December 1, 2025): The News & Observer confirmed today that UNC Health and Cigna have officially terminated their contract as of December 1, 2025. The N&O reports this dispute is "part of a broader Triangle trend where hospital-insurer contract breakdowns threaten patients' in-network access." Read their coverage here: https://www.newsobserver.com/news/business/article313284070.html

Tomorrow, I will lose my doctor.

Not because I moved or because she retired. But because UNC Health and Cigna couldn't reach a contract agreement. I'm one of 60,000+ patients caught in the middle.

I received my letter on October 25th, giving me just 36 days to find a new primary care physician during cold and flu season, when appointments are already scarce.

But here's what keeps me up at night as an RCM strategist with 23 years of experience:

This didn't have to happen.

And if you're a provider watching this unfolding, you need to understand—your practice could be next.

What Every Healthcare Provider Can Learn from the UNC Health - Cigna Contract Dispute and Termination

As of November 29th, negotiations remain unresolved. Starting December 1, UNC Health will be out-of-network for all Cigna commercial plans.

Duke Health faced a similar showdown with Aetna in early October. They reached an agreement at the eleventh hour, but it came only after public pressure, patient outcry, and months of uncertainty.

WakeMed had its own battle with UnitedHealthcare earlier this year.

Do you see the pattern?

These aren't isolated incidents. They're symptoms of a broken payer-provider relationship model where:

Payers implement aggressive cost-control policies like downcoding and prior authorization barriers.

Providers absorb mounting losses until margins collapse.

Negotiations break down when health systems finally push back.

Patients become collateral damage.

The question isn't if this trend will continue. It’s whether your practice is ready before it hits your contracts.

The Warning Signs You Might Be Missing

Most practices don't realize they're in trouble until it's too late.

Here's what happens often:

6-12 Months Before Contract Expiration:

Payer implements new "claims review" policies (often automated downcoding).

Denial rates creep up slowly—2%, then 5%, then 10%.

Your staff spends more time on appeals and prior authorizations.

Revenue dips slightly, but it's attributed to "seasonal variation" or "coding issues."

3-6 Months Before Expiration:

You realize the payer has been systematically underpaying for months.

The financial impact is now significant enough to notice.

You enter contract negotiations already at a disadvantage.

The payer knows you've absorbed losses and expects you to continue.

Final 30 Days:

Negotiations are stalled because the gap is too wide.

Public notices go out (if you're large enough).

You're forced to choose between accepting unfavorable terms or going out-of-network.

Your patients suffer either way.

Sound familiar? This is exactly what happened with UNC and Cigna.

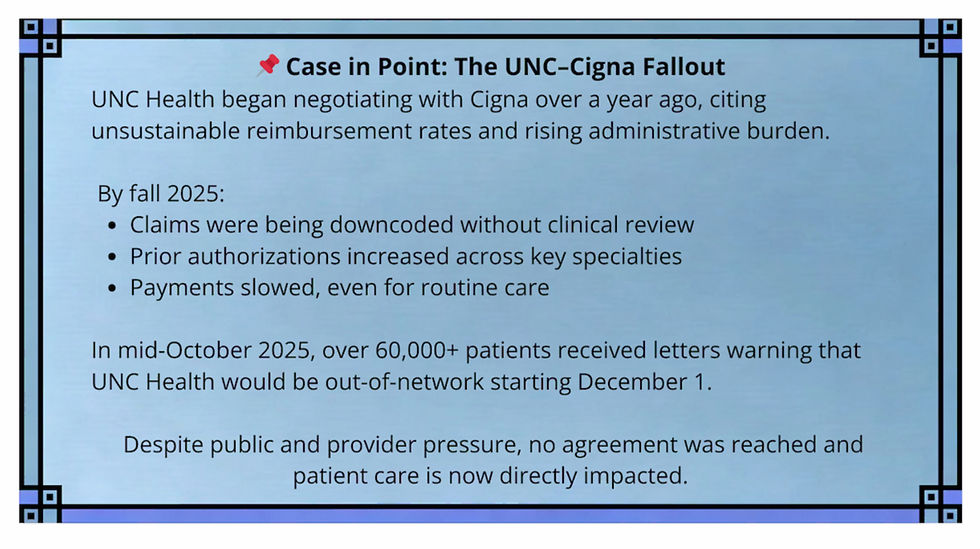

UNC Health reportedly began negotiations with Cigna more than a year ago, citing unsustainable reimbursement rates and rising administrative costs. By fall 2025, physicians had already begun seeing downcoded claims, delayed payments, and increased prior authorization denials.

Patients — including those undergoing active treatment were notified in mid-October that their care could be disrupted starting December 1, 2025. Despite public attention, no agreement had been reached at the time of this blog’s publication.

What UNC's Situation Reveals About Payer Tactics

While specific contract details aren't public, the pattern is clear.

Cigna's approach (like many major payers) has increasingly relied on:

Automated downcoding of E/M claims without clinical review.

Aggressive prior authorization requirements that delay or deny care.

Reimbursement rates that haven't kept pace with inflation in healthcare costs

"Take it or leave it" negotiating postures with smaller practices.

Even a system as large as UNC Health with significant market leverage couldn't bridge the gap.

What does that mean for your independent practice or small health system?

If UNC couldn't force Cigna to the table with a reasonable agreement, what leverage do you have?

The answer: You need to see the problems before the contract renewal season.

The Three Questions Every Provider Should Ask Right Now

1. Do you know what each payer is actually costing you?

Not just your contracted rates—but your net reimbursement after:

Downcoding adjustments

Denials and partial payments

Administrative burden (staff time on appeals, prior authorizations, claim corrections)

Delayed payments and aging AR

Most practices track gross charges and payments. Few track the hidden erosion that makes a contract unprofitable long before renewal.

2. Can you quantify your leverage in negotiations?

Health systems like UNC and Duke have market power because they serve large patient populations. But even they struggle.

Your leverage comes from:

Understanding your patient mix by payer (who needs you most?)

Documenting the financial impact of payer policies with hard data.

Having alternative options (other payers, cash-pay services, direct primary care models).

Being willing to walk away from an unprofitable contract.

If you don't know your numbers, you're negotiating blind.

3. What's your contingency plan if negotiations fail?

UNC spent months notifying patients, coordinating continuity of care, and managing the fallout. Most practices have no plans at all.

Ask yourself:

If you lost a major payer on 30 days' notice, could you survive financially?

Do you have the infrastructure to bill out-of-network or offer alternative payment options?

Can you communicate effectively with affected patients?

Have you identified which patients are at the highest risk and need transition support?

What You Can Do Starting Monday

The UNC Health - Cigna contract dispute and termination situation is a wake-up call. Here's how to protect your practice:

Immediate Actions (This Week):

Pull a report of denials and adjustments by payer from the last 6 months.

Calculate your true cost-to-collect for each major payer.

Review your payer contract expiration dates for 2025-2026.

Identify which contracts are up for renewal in the next 12 months.

Strategic Actions (Next 30 Days):

Conduct a downcoding audit to identify systematic underpayments.

Benchmark your reimbursement rates against regional averages.

Document administrative burden (staff hours spent on appeals, prior authorizations).

Develop financial models showing break-even points for each payer.

Long-Term Protection:

Build revenue cycle infrastructure that catches underpayments in real-time.

Create a payer strategy that includes contract negotiation timelines.

Develop patient communication protocols for potential network changes.

Consider diversification (DPC models, cash-pay services, value-based contracts).

You Don't Have to Navigate This Alone

I built RevQuest LLC because I've watched this pattern destroy practices for over two decades. I've seen brilliant clinicians forced to close their doors, not because they provided bad care, but because they didn't see the revenue erosion until it was too late.

Tomorrow, I will become one of 60,000+ patients scrambling to find new care because two massive organizations couldn't reach an agreement.

But your patients don't have to be next.

I'm offering complimentary 15-minute contract risk assessments this week to 5 practices.

In that call, I'll help you identify:

✓ Hidden revenue leaks in your current payer contracts.

✓ Downcoding exposure you're not tracking.

✓ Early warning signs of contract breakdown.

✓ One quick action you can take immediately to strengthen your next negotiation.

🩺 If You're a Healthcare Provider, Here's What This Means for You:

UNC Health didn’t lose this contract overnight. They saw denials increase. They watched revenue slip. And by the time the warning letter went out, it was too late to course correct.

The same patterns are happening in smaller practices right now — just on a quieter scale.

If you're seeing:

More downcoded visits

Growing prior auth burden

Contracts up for renewal in 2025–2026...

You need to take a hard look before your patients get that letter.

You Don’t Have to Be Next

You still have time to avoid being next. You don’t have to guess. I built the tools. I’ve seen what works.

Let’s talk — provider to provider, strategist to operator.

Even a 15-minute conversation can show you what to check before 2026 renewals begin.

Because the best time to fix contract problems is before they become a crisis.

The second-best time is right now.

Cigna Healthcare is a registered trademark of Cigna Intellectual Property, Inc. References to Cigna Healthcare’s R49 policy are for informational and educational purposes only. Revenue Reset™ and RevQuest LLC™ are independent entities and are not affiliated with or endorsed by Cigna Healthcare or any other payer referenced.

Marketta Burrell, CRCP, is the founder and CEO of RevQuest LLC™ and creator of Revenue Reset™, Downcoding Defense™, and the Denial Decoder™.

With over 23 years of healthcare revenue cycle experience, she helps providers navigate payer policy changes, identify hidden underpayments, and strengthen revenue integrity across their practice.

You don’t have to face payer pressure alone.

RevQuest LLC™ and Revenue Reset™ are here to support you — from strategy to systems to survival.

📚 Sources & Further Reading

Payer Policy & Industry Trends

UNC Health, Cigna at Odds Over New Contract; Patients Face Network Change *News & Observer* -Published: November 2025 https://www.newsobserver.com/news/business/article313206402.html

Synopsis: Highlights the ongoing dispute between UNC Health and Cigna, how it could affect over 60,000 North Carolinians, and echoes concerns about rising payer demands and shrinking reimbursements.

Cigna Intends to Unilaterally Downcode E/M Claims *HealthLeaders* https://www.healthleadersmedia.com/revenue-cycle/cigna-intends-unilaterally-downcode-em-claims

Synopsis: Explains payer-side motivations behind R49 and how the policy could shift millions in costs onto providers.

Cigna’s New Reimbursement Policy: E/M Code Downgrades *StreamlineMD* https://streamlinemd.com/cignas-new-reimbursement-policy-e-m-code-downgrades/

Synopsis: Offers a provider-focused summary of what’s at stake under the R49 policy and how practices should respond.

RevQuest LLC Blog Post & Case Studies (Internal Sources)

The Hidden Strategy Behind Cigna's R49 Downcoding Policy *RevQuest LLC Blog* — September 24, 2025 https://www.revquestrcm.com/post/the-hidden-strategy-behind-cigna-s-r49-downcoding-policy

Breaks down the implications of Cigna’s R49 policy on E/M downcoding, revenue loss, and administrative burden—and why many providers may choose to exit payer networks.

I'm an RCM Expert. I Just Became a Patient Statistic in the UNC–Cigna Dispute *RevQuest LLC Blog* — October 27, 2025 https://www.revquestrcm.com/post/rcm-expert-unc-cigna-dispute-patient-statistic

A dual-perspective analysis from a revenue strategist who became one of the 60,000+ patients affected by the network fallout.

$25,000 Recovered in 45 Days *RevQuest LLC Case Study* — 2025 https://www.revquestrcm.com/case-studies

Demonstrates how targeted A/R and coding recovery through RevQuest’s Revenue Reset™ framework can prevent losses caused by payer friction.

Internal Source (PDF): RevQuest LLC Case Study $25,000 Recovered in 45 Days

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

Comments