Cigna and Aetna Are Increasing Automatic Downcoding — Here’s What Your Practice Needs to Watch Right Now

- revenuequestllc

- Nov 13, 2025

- 6 min read

Published: November 12, 2025

Last Updated: November 12, 2025

Author: Marketta Burrell, CRCP

Company: RevQuest LLC

Important Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, medical, or professional advice. Healthcare compliance requirements can vary by state, payer, and type of practice. Readers should consult with qualified healthcare attorneys, compliance professionals, and their professional advisors before implementing any compliance strategies discussed in this article. RevQuest LLC does not provide legal advice and recommends working with qualified legal counsel for specific compliance guidance.

A growing pattern of automated E/M reductions is appearing across multiple states, and most practices won’t see the losses until the month-end numbers don’t add up. Your E/M payments may already be shifting. Here’s how to identify early downcoding patterns before they become month-end shortfalls.

Major insurers are quietly moving payment decisions to automated systems, and E/M payments nationwide are already showing the impact.

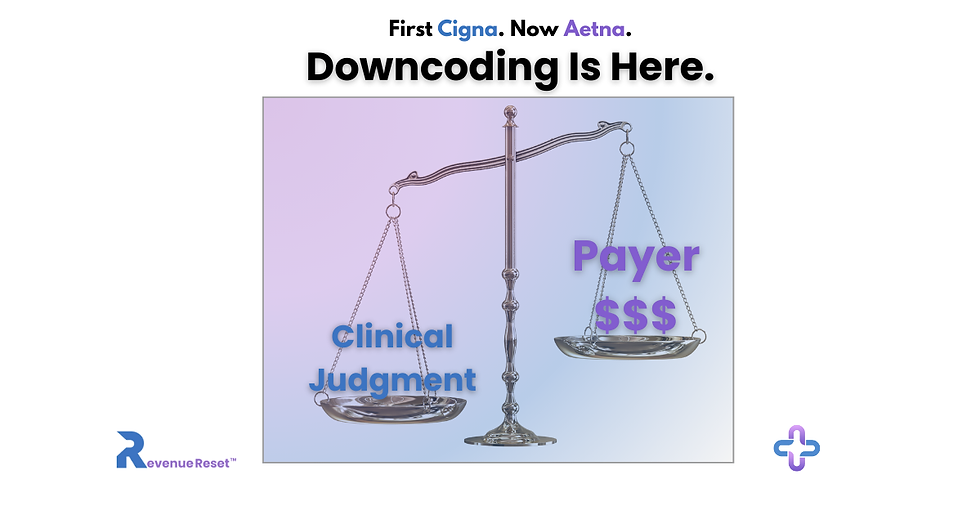

These new edits from Cigna Healthcare and Aetna automatic downcoding may seem small on the surface, but the financial consequences build quietly, often before a clinic realizes anything has changed.

That delay between the adjustment and the actual loss is where practices get hit the hardest.

What Cigna and Aetna Downcoding Patterns Are Changing

Cigna Healthcare: R49 Coding Accuracy Review

Cigna’s policy, as of Oct 1, automatically reduces higher-level E/M visits by one level when its system believes the chart doesn’t support the complexity billed. Appeals require submitting complete medical records, and the timeline to act is short.

Aetna: Claim & Code Review Program

Aetna has expanded its automated reviews to target high-dollar claims, implants, anesthesia, bundled services, and emergency-level visits. These decisions rely solely on claim data — not documentation, and adjustments occur after payment.

Both approaches shift coding decisions to algorithms, not clinicians. That’s the core problem.

Regulators Are Paying Attention — Because Providers Are Losing Money

California forced pauses and reviews on both insurers’ edits after physician groups warned that automated downcoding could put clinics at financial risk. Texas organizations are pushing for the same. National associations and lawmakers are raising similar concerns.

When regulators step in, it’s because practices are already absorbing the losses quietly.

This tells us two things:

These edits are widespread.

Providers are losing money before they even realize what’s happening.

The Real Risk: Hidden Underpayments No One Notices Immediately

Here’s where practices get caught off guard:

The adjustment looks small on a single claim.

The payer doesn’t always change the CPT code on the remittance.

The gap becomes visible only when the weekly or monthly totals fall short.

By then, the appeal window had closed on dozens of claims.

Underpayments rarely feel urgent until the financial hit becomes obvious, and at that point, the recoverable revenue is already weeks old.

That’s why the response has to happen early, not after the damage shows up on a report.

To make this real for a clinic: A steady stream of mid-level E/M visits dropping a level can quickly turn into a four-figure weekly loss. Missing those variances for a month can put the practice behind without a clear explanation of why.

The message to providers needs to be simple: the cost of waiting is higher than the cost of checking.

This Is Where Your Practice Sets Itself Apart

Most practices won’t see these new edits for what they really are. They’ll treat them like another payer nuisance — frustrating, yes, but manageable.

But you’re not that kind of practice.

You’re the kind of practice that rises when things tighten.

The kind that doesn’t wait for revenue to slip before acting.

The kind that notices when a policy looks small on paper but has a bigger story underneath.

And that’s the part most practices are missing.

Because the real impact of these automated edits isn’t in the individual claim adjustments.

It’s in the pattern forming underneath them, the one no one has fully talked about yet. Most practices won’t connect those dots until their month-end numbers don’t make sense.

You’re already ahead of them simply because you’re reading this.

But here’s the information gap no one’s addressing:

These downcoding edits aren’t happening in isolation.

They’re tied to something broader — and the early signs are already showing up in remittances.

I’ll break that down in my next brief.

For now, just know this:

There’s a deeper shift happening behind these payer edits, and I’m building a solution to help practices handle what comes next, not just what’s happening today.

Stay close. The next part matters.

The Hidden Cost of Doing Nothing

The budgetary impact appears later, after enough downcoded claims accumulate to disrupt monthly numbers.

Identifying adjustments early matters more than explaining the policies themselves.

And that’s exactly where most practices fall behind.

Where the Denial Decoder™ Fits into This Moment

To stay ahead of these silent adjustments, RevQuest LLC™ built the Denial Decoder™, a tool designed for fast detection and early pattern recognition.

The Denial Decoder™ helps practices:

See the downcoded claims before the losses compound.

Identify patterns tied to Cigna R49, Aetna CCRP, and other payers’ E/M level reductions.

Flag discrepancies that aren’t obvious on the remittance.

Respond within appeal windows instead of after.

Beta access is now open in limited slots—making this the ideal moment to evaluate how these edits may already be affecting your revenue.

What to Do Next

Rather than increasing internal workload or speculating on which claims require attention, practices can submit a small sample of recent remittances for review to determine if they are impacted by the Cigna and Aetna downcoding.

RevQuest LLC identifies variances quickly and provides clear next steps; no internal tracking needed.

· Step 1 – Submit a de-identified (redacted) remittance advice or EOB

· Step 2 – Receive a variance summary

· Step 3 – Decide next actions

You shouldn’t have to dig for underpayments. You should simply know where they are and how much they’re costing your practice.

Before You Go

There’s one more angle to these new payer edits that most clinics haven’t considered yet, and it’s the part that will determine who keeps their revenue next year and who quietly loses ground.

I’m running final checks on a new RevQuest LLC solution built specifically for this gap, addressing the revenue leaks no dashboard shows.

More information will be available shortly. To receive the initial update when it launches, stay tuned; this upcoming release might be the key to identifying losses promptly instead of finding them months down the line.

I’m not ready to release the full details yet, but it’s coming next.

This next piece may be the difference between catching these losses early and discovering them months later.

Cigna Healthcare is a registered trademark of Cigna Intellectual Property, Inc. References to Cigna Healthcare’s R49 policy are for informational and educational purposes only. Revenue Reset™ and RevQuest LLC™ are independent entities and are not affiliated with or endorsed by Cigna Healthcare or any other payer referenced.

Marketta Burrell, CRCP, is the founder and CEO of RevQuest LLC™ and creator of Revenue Reset™, Downcoding Defense™, and the Denial Decoder™.

With over 23 years of healthcare revenue cycle experience, she helps providers navigate payer policy changes, identify hidden underpayments, and strengthen revenue integrity across their practice.

You don’t have to face payer pressure alone.

RevQuest LLC™ and Revenue Reset™ are here to support you — from strategy to systems to survival.

📚 Sources & Further Reading

Payer Policy & Industry Trends

Cigna R49 (Automatic Downcoding of E/M Codes) *California Medical Association (CMA)*, https://www.cmadocs.org/newsroom/news/view/ArticleId/50421/Cigna-to-Delay-Downcoding-Policy

Details Cigna’s automatic E/M downcoding policy, documentation thresholds, and regulatory responses.

Aetna Claim & Code Review Program (CCRP) *Davis Wright Tremaine LLP (DWT)* https://www.dwt.com

Outlines Aetna’s expanded code-edit audits, retrospective E/M reviews, and high-dollar claim reductions.

National Patterns of Algorithmic Downcoding *Oncology News Central* https://oncologynewscentral.com/articles/downcoding-practices-by-payers

Confirms increasing payer complexity, rising administrative burden, and financial strain for practices.

RevQuest LLC Blog Citations (Internal Sources)

Understanding Cigna’s R49 Policy: A Critical Update for Providers *RevQuest LLC Blog* — September 24, 2025 https://www.revquestrcm.com/post/the-hidden-strategy-behind-cigna-s-r49-downcoding-policy

“Even small changes in how high-level E/M codes are evaluated can create significant revenue disruption for outpatient-heavy practices.”

The First Week of Cigna R49: What Practices Are Seeing Already *RevQuest LLC Blog* — October 3, 2025 https://www.revquestrcm.com/post/the-first-week-of-cigna-r49

“Within days of implementation, providers reported auto-downcoding of Level 4 visits — often without documentation requests.”

The Silent Downcoding Trend: Why It’s No Longer Just About Cigna *RevQuest LLC Blog* — October 16, 2025 https://www.revquestrcm.com/post/the-silent-downcoding-trend-why-it-s-no-longer-just-cigna

“R49 is now a signal of wider change — other payers are watching and replicating the approach, putting more pressure on provider margins.”

Disclaimer: This content is for educational and strategic analysis purposes only and does not constitute legal, financial, medical, or business advice. Healthcare practices should consult with qualified legal, financial, and business advisors familiar with their specific circumstances, contracts, and local market conditions before making any strategic decisions regarding payer contracts or business operations.

Comments